Translation and analysis of words by ChatGPT artificial intelligence

On this page you can get a detailed analysis of a word or phrase, produced by the best artificial intelligence technology to date:

- how the word is used

- frequency of use

- it is used more often in oral or written speech

- word translation options

- usage examples (several phrases with translation)

- etymology

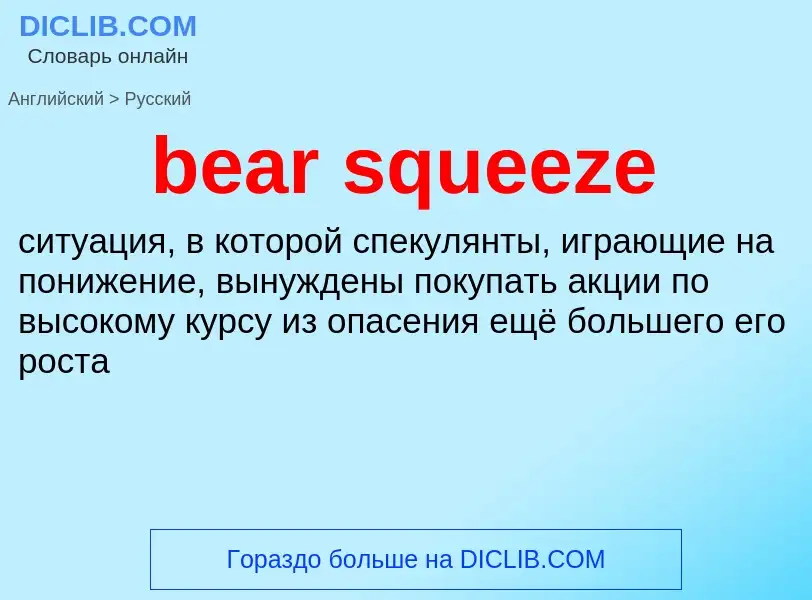

bear squeeze - translation to russian

сумма ценных бумаг, проданная без покрытия, путём заимствования их у брокеров (игра на понижение)

2) ограничение (кредита) || ограничивать

3) разг. тяжёлое положение; затруднение; узкое место

4) см. bear squeeze

- squeeze down prices

- squeeze out

- bear squeeze

- credit squeeze

- financial squeeze

- food squeeze

- full employment profit squeeze

- liquidity squeeze

- money squeeze

- price squeeze

- profit squeeze

- short squeeze

Wikipedia

The short interest ratio (also called days-to-cover ratio) represents the number of days it takes short sellers on average to cover their positions, that is repurchase all of the borrowed shares. It is calculated by dividing the number of shares sold short by the average daily trading volume, generally over the last 30 trading days. The ratio is used by fundamental and technical traders to identify trends.

The days-to-cover ratio can also be calculated for an entire exchange to determine the sentiment of the market as a whole. If an exchange has a high days-to-cover ratio of around five or greater, this can be taken as a bearish signal, and vice versa.

The short interest ratio is not to be confused with the short interest, a similar concept whereby the number of shares sold short is divided by the number of outstanding shares. The latter concept does not take liquidity into account.